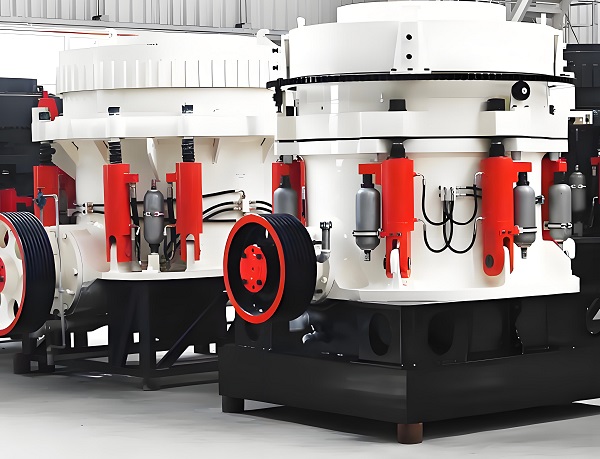

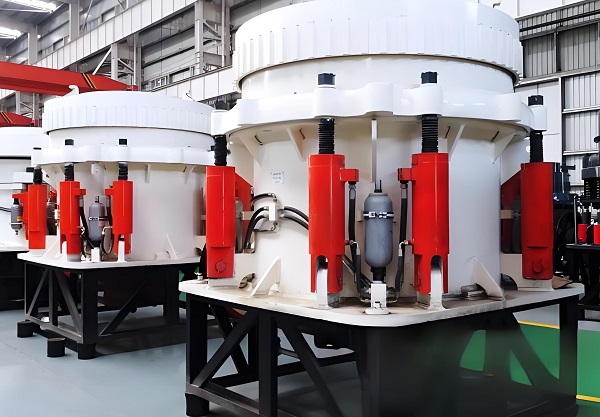

In mining, construction aggregate processing, and other fields, multi-cylinder cone crushers, due to their efficient crushing and high-quality finished products, have become essential equipment for handling high-hardness materials. However, with their numerous models and brands, coupled with stringent requirements for operating conditions, blindly purchasing can easily lead to problems such as insufficient production capacity and uncontrolled costs. To help practitioners avoid purchasing pitfalls and accurately match production needs, this article outlines key points from needs identification to after-sales maintenance, creating a practical purchasing guide.

Multi-cylinder cone crushers, with their high crushing ratio, high efficiency, and excellent finished product shape, have become essential equipment for processing high-hardness materials in industries such as mining and construction. However, equipment selection is complex and the market is rife with brands. Blindly purchasing can easily lead to capacity mismatch and cost overruns. The following guide provides a professional purchasing solution, covering the entire process from needs identification, brand selection, equipment inspection, contract signing, and after-sales support.

1.Accurately Identify Needs: Clarify Core Parameters and Operating Condition Compatibility

Pre-purchase needs analysis is key to avoiding misjudgment. Accurately determining needs requires considering key factors such as material characteristics and production capacity targets. First, focus on material properties. Multi-cylinder cone crushers are suitable for high-hardness materials with a hardness of ≤300 MPa (such as granite and basalt). It's important to clearly determine the material's Proctor hardness coefficient (f ≤ 16 is recommended), moisture content (to avoid clogging caused by excessive moisture), and impurity content (especially the percentage of metal impurities, which impacts the need for over-metal protection). For example, when crushing ultra-hard materials like granite, the equipment's crushing force and liner wear resistance should be prioritized. When processing high-contamination mining materials, models with hydraulic automatic cavity cleaning and comprehensive over-metal protection should be prioritized.

Second, determine production capacity and particle size requirements. Equipment capacity ranges from 81-1100 t/h, with adjustable output particle size from 8-38 mm. These parameters should be determined based on the overall production line planning. For the secondary crushing stage of a large aggregate production line, a larger model with a capacity of 500 t/h or more (such as the Zhejiang Shuangjin SJ series) is recommended. For fine crushing needs in small and medium-sized metal mines, a model with a capacity of 200-300 t/h is suitable. At the same time, clarify the required percentage of cubic particles in the finished product. Laminated crushing technology can increase the yield rate to 98%, making this a particularly important metric for projects with high particle shape requirements.

Finally, consider the site and supporting conditions. Measure the length, width, and height of the installation site in advance to confirm compatibility between the main unit and supporting equipment such as the motor and screen. Also, verify the site's power supply capacity. Multi-cylinder cone crusher motors typically range from 160 to 630 kW, ensuring a stable power supply. Furthermore, in remote areas, consider the road capacity and height restrictions for equipment transportation.

2. Brand and Manufacturer Selection: Considering Quality, Price, and Service

There are numerous brands of multi-cylinder cone crushers on the market, and careful selection is required based on overall strength, cost-effectiveness, and service offerings.

Major domestic and international brands each have their own advantages. Among international brands, Sandvik and Metso dominate the high-end market with technological advantages like constant crushing chamber design and intelligent monitoring systems. However, these advantages come at a premium and require long spare parts cycles. Domestic brands like Zhejiang Shuangjin and Zhengzhou Mining Machinery Group are known for their cost-effectiveness and fast service response. The Zhejiang Shuangjin SJ series features a high-strength, one-piece cast casing and convenient hydraulically adjustable discharge opening, making it suitable for users seeking cost-effectiveness. The Zhengzhou Mining Machinery HPC series achieves efficient lamination crushing through optimized speed and chamber shape, making it suitable for a variety of industrial scenarios.

When selecting a manufacturer, consider three key factors: First, production capacity. Prioritize those with independent R&D capabilities and plant areas exceeding 10,000 square meters. Raw material procurement (e.g., whether ultra-high-alloy manganese steel liners are used) and production processes can be verified through video verification or on-site inspections. Second, consider user case studies. Manufacturers should be required to provide application examples using the same materials and production capacity. Ideally, an on-site visit to the equipment operation site should be conducted to observe production stability and finished product quality. Third, review customer reviews. Learn about the manufacturer's after-sales service reputation through industry forums and third-party platforms to avoid small-scale workshops with unresponsive after-sales service. Price comparisons should be rational and objective. Equipment prices are influenced by quality, cost, and supply and demand, and typically range from tens of thousands to hundreds of thousands of yuan. Excessively low prices may indicate cutting corners, such as substituting ordinary steel for high-strength castings. Excessively high prices require verification of the reasonableness of the technological premium, such as whether the intelligent control system is essential for production. It is recommended to screen quotations from 3-5 manufacturers that meet your requirements, considering the equipment configuration rather than simply comparing prices.

3. Equipment Inspection and Contract Signing: Key Steps for Risk Mitigation

After selecting a candidate manufacturer, verify the equipment quality through a professional inspection, and then clarify responsibilities and obligations through a standardized contract. The on-site inspection focused on three key areas: First, the quality of core components, checking whether the casing is integrally cast, whether the liner is made of a high-wear-resistant alloy such as ZGMn18Cr2, and whether the hydraulic system is a well-known brand. Second, performance testing, requiring the manufacturer to conduct no-load and loaded test runs to observe the equipment's operating noise and vibration, and verify the accuracy of the discharge opening adjustment and the sensitivity of the iron overload protection. Third, technical details, inquiring about the replacement cycle of wearing parts and the complexity of the maintenance process, such as whether the hydraulic automatic cavity clearing function can save downtime. The contract must clearly define the following key terms: First, equipment specifications, specifying key indicators such as model, production capacity, and motor power, along with a manufacturer's parameter confirmation sheet; Second, service guarantees, specifying the "three guarantees" period (recommended for a one-year or longer warranty on the main unit), on-site installation and commissioning responsibilities, and the supply cycle for consumable parts (for remote areas, delivery within 72 hours is required); Third, payment and breach of contract terms, adopting a "prepayment + delivery + warranty deposit" model, with a 10%-15% warranty deposit to be paid after three months of normal operation. Compensation for delayed delivery and equipment discrepancies should also be specified.

4. After-sales and Operations: Ensuring Long-term Stable Operation

Equipment delivery is not the end of the purchase process; a comprehensive after-sales and operations and maintenance system directly impacts its service life and overall profitability.

The acceptance process requires rigorous scrutiny, verifying the equipment model and accessories list against the contract specifications, testing to ensure crushing performance meets specifications, and confirming that all accompanying documentation (manual, warranty card, and accessory drawings) is complete. During installation and commissioning, on-site guidance from manufacturer technicians is required. Operators must be trained in skills such as adjusting the discharge opening and troubleshooting. In particular, they must be familiar with the hydraulic system and intelligent monitoring panel.

Daily operation and maintenance require the manufacturer's support. Confirm the after-sales response time with the manufacturer in advance (remote guidance within 24 hours and on-site service within 48 hours is recommended). Inquire about spare parts procurement channels and pricing. Annual maintenance agreements can be signed to reduce maintenance costs. Also, consider equipment upgrade possibilities, such as whether an intelligent wear monitoring system can be added later to accommodate future production needs.

When purchasing multi-cylinder cone crushers, a logical approach of "demand-first, rigorous screening, meticulous attention to detail, and long-term assurance" should be established. First, define required parameters based on material, production capacity, and site requirements. Then, select manufacturers based on brand recognition and user case studies. Risks can be mitigated through on-site inspections and standardized contracts. Ultimately, equipment performance can be guaranteed through after-sales maintenance. Comprehensive control of the entire process, from initial selection to ongoing operation and maintenance, is crucial for mitigating procurement risks and is the key to achieving long-term, efficient operation and reducing overall costs.

Save Time! Get A Detailed Quotation Quickly.